Holistic Approach

Agricultural risk management (ARM) is the process towards becoming better at dealing with risks. It requires anticipating potential risks and planning solutions in advance, so as to limit their negative consequences.

Key elements of ARM can be summarized by the ARM cycle that includes the following steps: the identification of the risks, the assessment of the risks, the identification of risk management tools to put in place, the implementation of the tools, and monitoring and evaluating the effectiveness of the tools and strategy that are in place.

A holistic approach to agricultural risks means that no risk is considered in isolation. All risk elements and interactions, including strategy and policy, have to be considered.

This approach encompasses the following steps:

- Assess and prioritize agricultural risks

- Identify tools and strategies

- Planning, implementing and evaluating

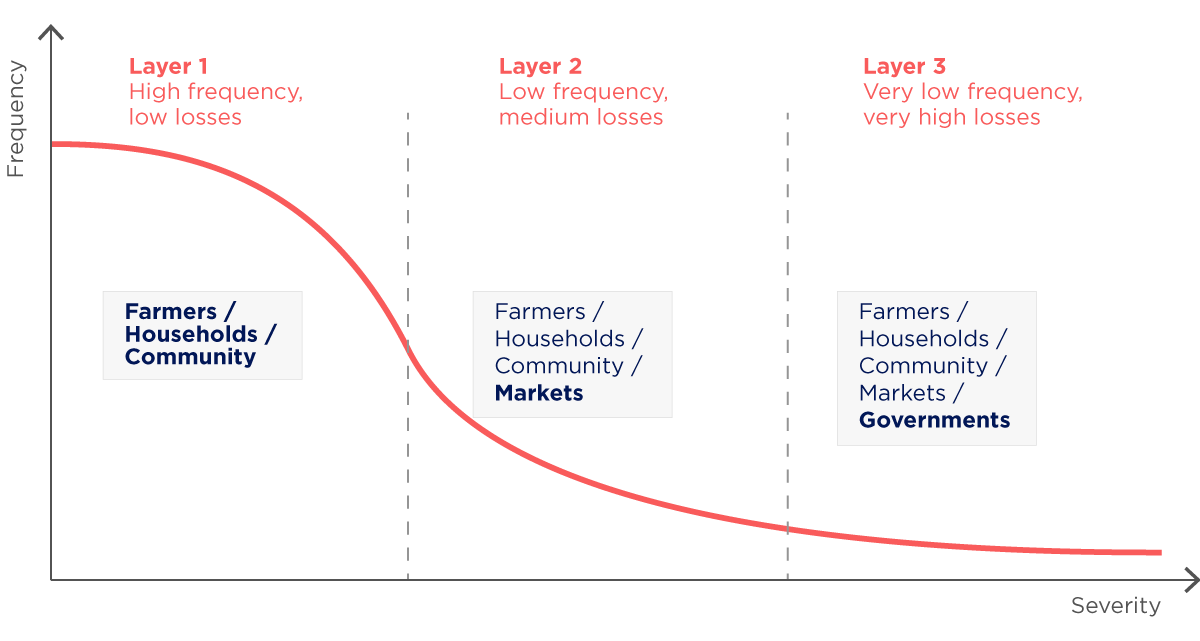

There are many stakeholders involved in different ways in agricultural risk management practices. They can be grouped into three categories:

- Micro level: farmers and small businesses;

- Meso level: farmers’ organizations, NGOs, suppliers of inputs, financial service providers;

- Macro level: government, international organizations.

Assess and prioritize agricultural risks

Before identifying the specific instruments to manage risks, decision-makers and agricultural supply chain participants need to assess risk systematically and comprehensively. The two basic elements that are crucial to assess risks are frequency and severity:

- Frequency of risk refers to how often a risk event occurs over a particular time frame. It conveys an idea for a potential future occurrence but does not provide any certainty as to when the event or hazard may occur (again).

- Severity describes the magnitude of losses associated with the occurrence of an event/hazard. It can be measured in terms of losses to income, production, livestock and human.

The quantification of losses to risk event is based on an average and/or worst-case scenario. This is because risk impacts are not limited solely to current occurrences – they often manifest their negative consequences in the future as well. Take, for example, a bushfire that may cause a reduction in soil fertility. This affects farmers yield beyond a particular farming season until measures are taken to address fertility issues. Thus, both the average severity of a risk and its maximum severity are relevant when assessing risks. In considering these two elements of frequency and severity, stakeholders need to answer these three questions during agricultural risk assessments:

- How often does the risk occur over a given time period? This gives us the frequency.

- What are the average consequences in terms of lost production or income? This gives us the average expected severity.

- What are the worst consequences that can come about in terms of lost production or income – the worst-case scenario? This gives us the maximum severity to be expected.

The impact of risks is measured (quantified) in quantitative and/or monetary terms as losses due to occurrence of the negative event. Monetary terms are used mostly for comparability and convenience. It is difficult to predict the impacts of agricultural risks precisely, since most of them may have several consequences in the short and long term, depending on events in time and space. Many risks are also mutually interlinked.

Identify tools and strategies

Strategies

These are the three strategies to manage risks in agriculture:

- Risk mitigation encompasses actions taken to reduce exposure to, the severity of, or probability of loss from the event. Common mitigation strategies include irrigation, integrated pest management systems, the adoption of risk-reducing technologies such as improved seed varieties, and diversification across commodities, regions, and/or off-farm enterprises.

- Risk transfer signifies the transfer of risk from some participants and institutions onto others that might be better able to cope with it (e.g. by purchasing insurance, hedging, etc.). It involves the use of market transactions/instruments such as futures market contracts (or derivatives), or crop insurance to help manage yield risk. In developing countries, market-based transfer mechanisms such as index-based insurance products are opening innovative opportunities to transfer risks in agriculture.

- Even when farmers utilize mitigation and transfer strategies, they may still retain some degree of risk exposure. Coping with risks involves accepting the loss when the event occurs. Thus, risk coping involves activities for facing risks and dealing with resulting losses by, for example, precautionary savings, selling productive assets, seeking temporary employment, and other measures.

The figure below illustrates the three categories of risk management measures according to the characteristics of risks and the stakeholders’ involvement.

Tools

For each risk management measure explained above, several tools may be employed to achieve the risk management objective. The table below illustrates a wide menu of tools that can be adopted under each management option and the level of application.

| Risk Management Options | Micro-level (farm / household) | Meso-level (Market / Wider geographic area) | Macro-level (Government / National context) |

|---|---|---|---|

| Risk mitigation | - Avoid risk - Diversify income - Informal borrowing - Low-risk (low-return) production choices - Diversify farming entreprises - Intercropping - Climate-smart agriculture | - Training on risk management | - Macro-economic policy - Disaster prevention - Disease control regulation - Tax system for income smoothing - Social protection programmes |

| Risk transfer | - Crop sharing - Contract farming - Vertical integration - Informal risk pooling | - Insurance schemes - Warehouse receipt system - Commodities exchange and futures market - Contract farming | - State-subsidized insurance programmes |

| Risk coping | - Sale of assets - Consumption reduction - Labour reallocation - Informal/intra-family borrowing - Safety nets - Migration (domestic / international) | - Disaster relief - Cash transfers - Food aid - Agricultural support programmes |

Planning, Implementing and Evaluating

Once farmers and various actors are equipped with the knowledge of risks and the range of management options and tools, the next step is to select, plan and implement a set of ARM strategies. It is recommended for stakeholders to combine multiple options/tools because no instrument alone can guarantee effective agricultural risk management. When selecting a mix of risk responses to implement, it is essential to take into account the many linkages between different types of risk management options and tools/instruments. The selection should be based on the following five factors outlined by the World Bank (2016) and adapted by PARM[1]:

- Affordability of implementation;

- Feasibility of implementation;

- Coherence and compatibility with policy, programmes, priorities, practice and context;

- Long-term sustainability; and

- Scalability of implementation.

Monitoring involves the routine surveillance of how tool(s) or an overall strategy is performing. Evaluation is instead the process that assesses the success of the ARM strategy in meeting its goals. The outcomes or performance of the tools and strategy should be compared with their expected or required outcome and performance in terms of mitigating the negative consequence of risks.