Mitigation, Transfer and Coping

Agricultural risk management options

A first strategy to manage agricultural risk is to avoid it. However, not entering a business to avoid the risk of loss also avoids the possibility of earning profits. Elimination of risk is also a possibility but in situations where the risk ‘events’ cannot be avoided/eliminated, actors can mitigate, transfer or cope with those risks.

Risk mitigation encompasses actions taken to reduce exposure to, the severity of, or probability of loss from the event. Common mitigation strategies include irrigation, integrated pest management systems, the adoption of risk-reducing technologies such as improved seed varieties, and diversification across commodities, regions, and/or off-farm enterprises.

Risk transfer signifies the transfer of risk from some participants and institutions onto others that might be better able to cope with it (e.g. by purchasing insurance, hedging, etc.). It involves the use of market transactions/instruments such as futures market contracts (or derivatives), or crop insurance to help manage yield risk. In developing countries, market-based transfer mechanisms such as index-based insurance products are opening innovative opportunities to transfer risks in agriculture.

Even when farmers utilize mitigation and transfer strategies, they may still retain some degree of risk exposure. Coping with risks involves accepting the loss when the event occurs. Thus, risk coping involves activities for facing risks and dealing with resulting losses by, for example, precautionary savings, selling productive assets, seeking temporary employment, and other measures.

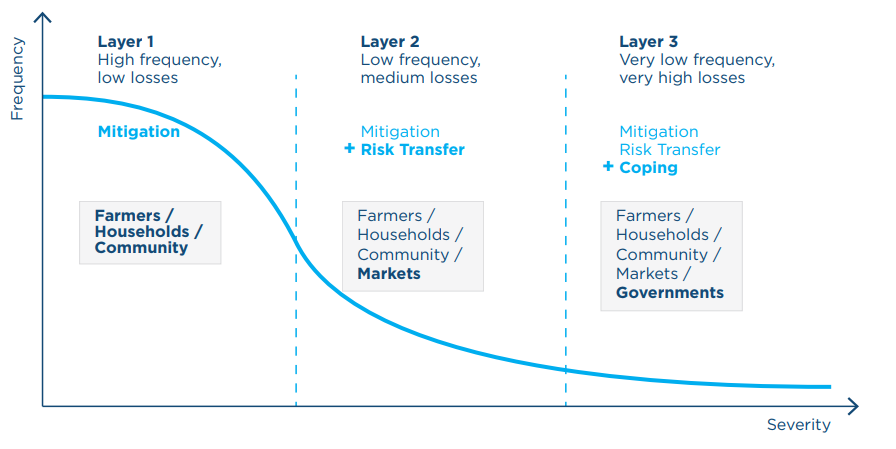

The figure below illustrates the three categories of risk management options according to the level of risks that they address.

Source: Adapted from World Bank (2016).

Agricultural risk management tools

For each risk management option explained above, several tools may be employed to achieve the risk management objective. They may be informal or formal. The informal arrangements may take the form of social networks, micro-savings, and seasonal off-farm labour activities that farmers may employ to protect themselves in times of risk events. Formalized tools include the use of financial instruments such as contacts, hedging and insurance. Some of these identified tools may also be privately implemented or publicly mandated such as government subsidies, insurance, credit guarantees, transfers and various forms of social protection programmes. Public measures are applied when private arrangements are dysfunctional or considered inappropriate, or simply do not exist, or are not enough to meet specific policy objectives. In essence, agricultural risks can potentially be managed at different levels as outlined below:

- At the micro level, by individual farms and firms, through enterprise strategies and various management practices.

- At a meso level, through joint action with other farmers and firms (such as community networks, farmer groups or cooperatives, and industry associations) and in interaction with other supply chain participants via transactions, contractual arrangements, information flows, and other means, with some distribution or sharing of risk among those players.

- At a macro or external level, where actors outside a specific supply chain—including banks, insurance companies, government agencies, and donor agencies share or absorb part or major elements of the risk through various financial instruments, physical stock-holding, and other means.

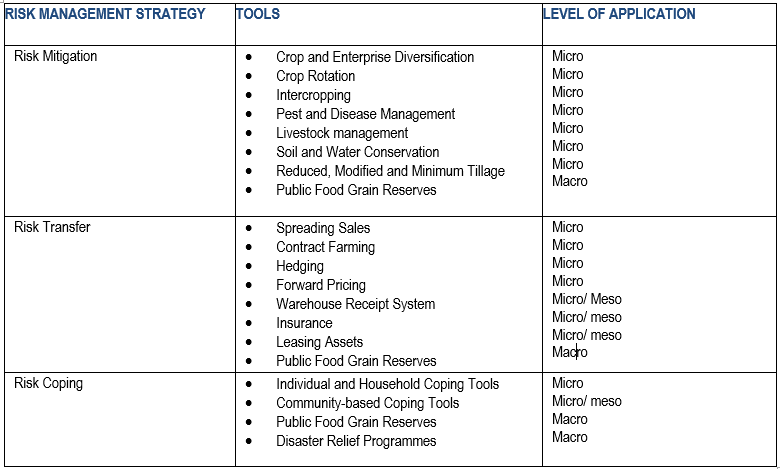

The table below illustrates a wide menu of tools that can be adopted under each management option and the level of application.

Source: PARM (2018). Module 4: Planning, implementing and evaluating ARM strategies. In “Agriculture Risk Management in Developing Countries: a learning course for practitioners” (by D. Kahan & S. Worth). Rome: PARM/IFAD.