Risk and how to manage it: A missing piece in China’s poverty eradication story

In early 2021, China declared victory in successfully eradicating extreme poverty, lifting every citizen above the national poverty line. China’s national poverty line was established in 2011 at RMB 2,300 (USD 340) per year at constant 2010 prices, equating to RMB 6.3 (USD 0.93) per day.[1]

Heated debate has been observed across international forums over how pertinent the definition may be. Indeed, the World Bank’s threshold for extreme poverty in low-income countries is set at $1.90 per day (at 2011 International prices[2]). For upper-middle-income countries such as China, it is $5.50 per day.[3] However, there are counterarguments to account for the rural-urban price difference, which decreases this poverty line for rural individuals. Nonetheless, the rapid economic growth experienced in China over the last decade is considered one of the world’s “economic miracles.” Only 0.5% of the population in 2016 in China lived below the poverty line, compared to other large countries such as India with 22% of its population (in the latest data available from 2011),[4] and Brazil with 4.6 % (in the latest data available from 2019),[5] continuing to live below the extreme poverty line defined by the World Bank today.

While where to draw the monetary poverty line is important, such a traditional, income-based definition is rather limited. It is of utmost importance that Chinese policy makers do not end their poverty eradication efforts there. It is critical that poverty is considered not only financially, but through a multidimensional lens with a holistic view. Risk, a key dimension of poverty, must be managed well to prevent the vulnerable from falling back into poverty. This editorial takes a multidimensional lens to poverty in China with a focus on risk. It further draws examples from field research in late 2018 in Shaanxi, where focus group discussions were carried out with 194 low-income, small-scale farmers by the MicroInsurance Centre at Milliman (MIC@M).[6] The average monthly household income of these farmers is in the range of RMB 2,000 to 3,000, or USD 295 to 443.

Rural Multidimensional Poverty Index

The Oxford Poverty and Human Development Initiative (OPHI) and the United Nations Development Programme developed the Global Multidimensional Poverty Index (MPI) in 2010 to measure acute poverty considering deprivations in three areas—health, education and living standards—across more than 100 low-income to middle-income countries. Complementing the traditional monetary poverty measure, the MPI is a well-recognised, international multidimensional measure of poverty. In recent research, the OPHI partnered with the Food and Agriculture Organisation of the United Nations (FAO) to further measure rural poverty with greater accuracy. To better identify the extreme poor within the rural context, the comprehensive Rural Multidimensional Poverty Index (R-MPI)[7] was developed, adding two key dimensions: rural livelihoods and resources, and risk. Figure 1[8] displays the five dimensions of the R-MPI and their corresponding indicators.

The conceptual framework and empirical tests of this framework have been implemented across Ethiopia, Malawi, Niger and Nigeria. Further qualitative and quantitative verifications on its relevance and validity have been tested on the proposed index over the last few years.

In this article, we focus on looking at poverty from a risk perspective. Being less tangible to poverty dimensions such as food security and health, risk is often less discussed, yet we believe the ability to manage risks is vital to getting out and staying out of poverty. We thus assess poverty in China within the risk dimension of the R-MPI, which is comprised of three indicators: credit denial, risk exposure and coping strategies and risk of climate shocks.

Credit denial[9]

The risk indicator of credit denial declines (i.e., poverty level worsens) if the household was denied credit access. This includes reasons for not borrowing such as credit being inaccessible, credit being too expensive, not having adequate collateral and not knowing any lender. Whilst there are limited global measures to assess credit denial, the World Bank’s Global Findex Database in 2017 showed that China had a relatively low proportion of its population (aged 15+) borrowing from financial institutions or using a credit card (22%) when compared to Organisation for Economic Co-operation and Development (OECD) countries.[10] The proportion drops when we focus in on the rural population in China and further decreases down to 12% when we look specifically at the poorest 40% of the population (Figure 2).

Moreover, when comparing borrowing in China across formal versus informal channels (such as friends and family), informal channels are accessed much more. Such disparity may indicate that, whilst there is demand for credit, access to formal credit is less adequate, particularly across the lowest 40% (income-wise) of the population. Furthermore, the Chinese culture of informal borrowing amongst friends and families in rural households is strong and culturally directed. In the research conducted by Turvey and Kong, such social preference is also found to be driven by trust in the use of informal credit.[11]

Figure 2: Proportion of Population Who Borrow (select Asian markets)

Our qualitative field research in Shaanxi presents a more optimistic landscape. Approximately half of the farmers interviewed had access to loans. Qualifying low-income households also had access to government-subsidised, year-long loans without any collateral requirements. Rural credit cooperatives were noted to be the most trustworthy financial institution by farmers who had physical access to them. Whilst the level of China’s credit denial rate is not conclusive, the Chinese low-income segment does not evidently access formal credit as frequently as the total and rural populations in China. Moreover, when compared to its higher-income neighbours within the Asia-Pacific region like Japan and Australia, this gap is also distinctly large in China.

Risk exposure and coping strategies[12]

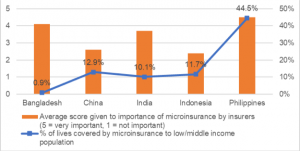

Microinsurance Coverage Ratio and Insurers’ Perspectives on Importance of Microinsurance

In preventing poor households from falling back into the poverty cycle, having formalised coping strategies—i.e., access to insurance or support from government or nongovernmental organisations (NGOs)—can be crucial when they are hit with shocks. Data on this measure is challenging to obtain due to limited research conducted and consistency across countries. The “Asia Microinsurance Supply-side Study” published by Milliman[13] found that insurers in China place relatively low importance on delivering insurance products to low-income populations (see Figure 3). Furthermore, the microinsurance coverage ratio for China (percentage of the low-/middle-income population covered by microinsurance) is also only at par with others in the Asia-Pacific region.

Consistent with such macrolevel statistics, our field research in Shaanxi also indicated that very few farmers had any form of insurance. Whilst many have sold their farming land to scaled cooperatives (and thus reduced their farming risks through land rental), they rarely have any risk management strategies in place. When a risk event occurs, farmers typically reduce expenses and borrow from friends and family. Some may access loans from the bank, or in the case of large-scale catastrophes, rely primarily on the support provided by the government. Most farmers indicate that they do not purchase insurance because of trust-related concerns and the complexity associated with both insurance purchase and claim processes. The anecdotal farmers’ experiences from Shaanxi, microinsurance coverage ratios, and supply-side perspectives indicate that China’s low-income citizens may require an improved range of adequate risk management tools to help prevent dropping back into poverty.

Risk of climate shocks

With a high dependence on natural resources, rural residents are particularly vulnerable to the risk of climate shocks.[14] According to the R-MPI framework, the risk of climate shocks indicator is defined as “the household’s probability of drought or flood or [if] drought, flood or temperature above 35 degrees Celsius in the critical period of maize production is greater than the respective median probability.”[15] This definition would need to be adjusted according to the specific crop(s) being considered. Based on the recent Global Climate Risk Index 2020,[16] China is ranked the 33rd most affected country (out of more than 180 countries ranked) in its level of exposure and vulnerability to extreme climate events. In the case of the farmers’ stories from Shaanxi, most farmers agreed that natural catastrophes were one of their greatest worries.

Many farmers feared risks associated with drought, flood and frost, which bring enormous damage to their productions. For example, a 2018 frost incident in Zhenba county caused full-scale damage to many farmers’ tea production. In the same region, other crops such as corn and rice suffered from a drought of more than 20 consecutive days where most of the production was lost. According to some estimates, by 2030[17] extreme heat could affect up to 45 million people in China, costing the country up to USD 1.5 trillion in gross domestic product (GDP) in an average year by 2050. Undoubtedly, efforts to fight climate change and mitigate its associated risks need to continue across China to keep poverty from reemerging.

Risk management for low-income households

Poverty is not just a lack of money; it is not having the capacity to realise one’s full potential as a human being. – Amartya Sen

Risk Management 360 (RM360)

Although China’s poverty eradication progress has been remarkable, it is not without challenges. Poverty need not be confined to the traditional monetary measure. In its place, in-depth measures such as the R-MPI provide a comprehensive view and way to tackle this multifaceted problem. From the risk perspective of this index, there is room for development in China.

Policy makers, public and private insurers and others working on poverty eradication and pro-poor initiatives in China can use current data or collect new data from rural and low-income households to design or facilitate the development of risk management solutions. Taking a holistic approach is needed, such as that of the MicroInsurance Centre at Milliman’s Risk Management 360, or “RM360” approach, displayed in Figure 4. It should be one that helps low-income people reduce risk (through prevention, preparation and adaptation, particularly for climate risks), better retain risk (through financial and nonfinancial means, such as improved access to credit and less credit denial) and transfer risk (through insurance, a potential key risk coping strategy).

Limitation: The data provided in this article must be viewed against the background of data availability and quality, which vary from country to country. The views and opinions expressed in this paper are those of the author and do not necessarily reflect the official policy or position of Milliman. Examples or suggestions of potential interventions within this paper are only examples, and implementation would require further evaluation.

This article was written as part of the IFAD-funded grant project ‘Managing risks for rural development: Promoting microinsurance innovations’ and reflects the views of the author.

AUTHORS:

Queenie Chow

COVER IMAGE:

IFAD Image Bank

[1] ChinaPower. Is China Succeeding at Eradicating Poverty? Retrieved 31 October 2021 from https://chinapower.csis.org/poverty/#easy-footnote-bottom-4-7017. The exchange rate of RMB 6.77 to USD 1 is used here and throughout this paper.

[2] World Bank. DataBank: Metadata Glossary. Retrieved 31 October 2021 from https://databank.worldbank.org/metadataglossary/gender-statistics/series/SI.POV.DDAY.

[3] World Bank. Poverty and Equity Data Portal. Retrieved 31 October 2021 from https://povertydata.worldbank.org/poverty/country/CHN.

[4] World Bank (2019). Poverty Headcount Ratio at $1.90 a Day (2011 PPP) (% of population). Retrieved 31 October 2021 from https://data.worldbank.org/indicator/SI.POV.DDAY?end=2019&start=2019.

[5] Ibid.

[6] This research was conducted as part of an International Fund for Agricultural Development (IFAD) grant-funded project, “Managing risks for rural development: Promoting Microinsurance innovations,” in collaboration with IFAD-financed Sustaining Poverty Reduction through Agribusiness Development in South Shaanxi Project (SPRAD-SS). Northwest University (NWAFU) assisted with collecting data for this research.

[7] Oxford Talks (20 November 2020). Measuring Rural Poverty With a Multidimensional Approach: Conceptual Framework and Empirical Results. Retrieved 31 October 2021 from https://talks.ox.ac.uk/talks/id/97fba7e8-7b55-4c17-9cc0-0c9efcdd8395/.

[8] This figure was adapted from the R-MPI graphic used in the presentation “Measuring Rural Poverty With a Multidimensional Approach: Conceptual Framework and Empirical Results,” given on 20 November, 2020. This event was organised by the Oxford Department of International Development, featuring speakers Dr Frank Vollmer, Dr Piero Conforti and Dr. José A. Rosero Moncayo. See https://talks.ox.ac.uk/talks/id/97fba7e8-7b55-4c17-9cc0-0c9efcdd8395/. Presentation recording here: https://youtu.be/xHMJ06Xeklk.

[9] xxxR-MPI formal definition of credit denial is “if the household was turned down in all its attempts to seek for credit or the household did not borrow because it did not seek for credit due to non-adequate reasons, such as believing the credit would be refused (i), too expensive (ii), inadequate collateral (iii) and now knowing any lender (iv).

[10] Author’s analysis of data from https://globalfindex.worldbank.org/.

[11] Turvey, C.G. & Kong, R. (December 2010). Informal lending amongst friends and relatives: Can microcredit compete in rural China? China Economic Review. Retrieved 1 November 2021 from http://dx.doi.org/10.1016/j.chieco.2010.05.001.

[12] The R-MPI formal definition of risk exposure and coping strategies is “the household suffered from covariate shocks or suffered from a shock but had no access to formalised coping strategies e.g., support from government or NGO.”

[13] Ismail, F., Sivarajah, N.S., & Chow, Q. (April 2020). Asia Microinsurance Supply-side Study. Milliman Research Report. Retrieved 1 November 2021 from https://us.milliman.com/en/insight/asia-microinsurance-supply-side-study.

[14] Insuresilience Global Partnership (10 April 2019). Linking climate risk with shock-responsive social protection. News release. Retrieved 1 November 2021 from https://www.insuresilience.org/blog/2019/04/10/linking-climate-risk-insurance-with-shock-responsive-social-protection/.

[15] This definition is from the presentation “Measuring rural poverty with a multidimensional approach: conceptual framework and empirical results,” given on 20 November 2020. This event was organised by the Oxford Department of International Development, featuring speakers Dr Frank Vollmer, Dr Piero Conforti and Dr. José A. Rosero Moncayo. See https://talks.ox.ac.uk/talks/id/97fba7e8-7b55-4c17-9cc0-0c9efcdd8395/. Presentation recording here: https://youtu.be/xHMJ06Xeklk.

[16] Eckstein, D. et al. Global Climate Risk Index 2020. Germanwatch Briefing Paper. Retrieved 1 November 2021 from https://germanwatch.org/sites/germanwatch.org/files/20-2-01e%20Global%20Climate%20Risk%20Index%202020_10.pdf.

[17] Woetzel, J. (1 September 2020). Three things China can do to fight climate change. McKinsey Sustainability. Retrieved 1 November 2021 from https://www.mckinsey.com/business-functions/sustainability/our-insights/sustainability-blog/three-things-china-can-do-to-fight-climate-change.